Revenue Recognition Principle Definition

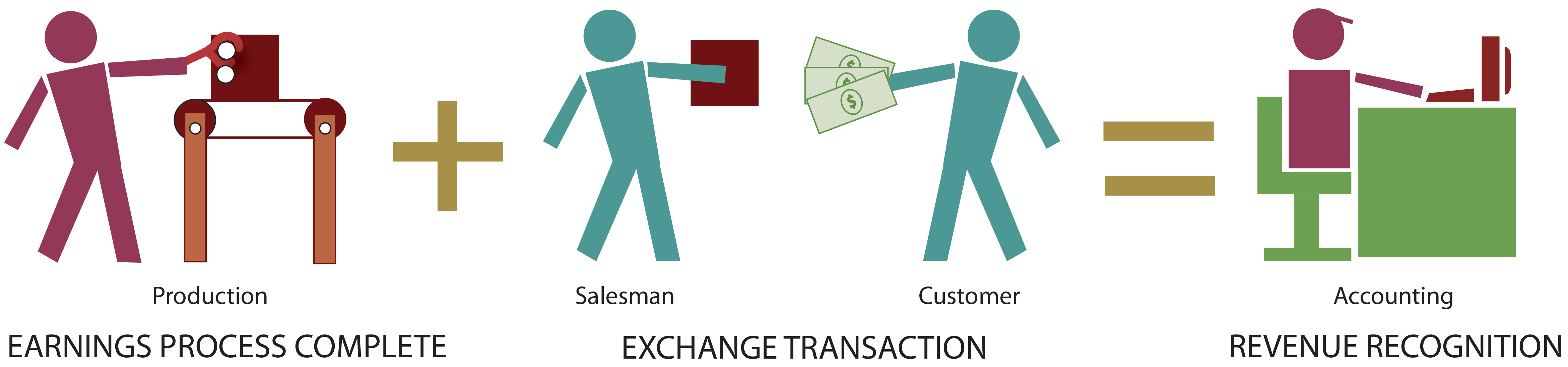

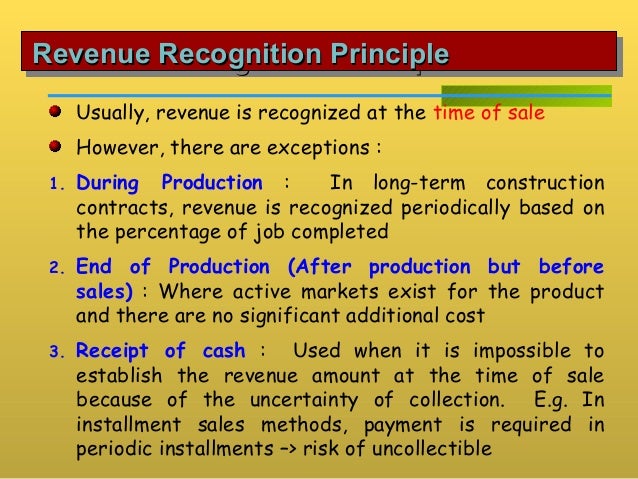

It means that revenues or income should be recognized when the services or products are provided to customers regardless of when the payment takes place.

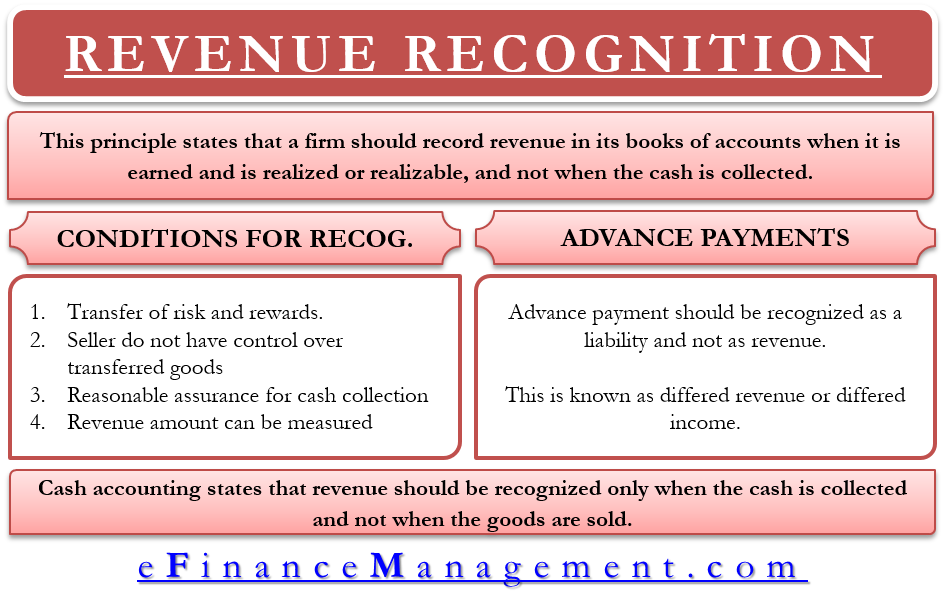

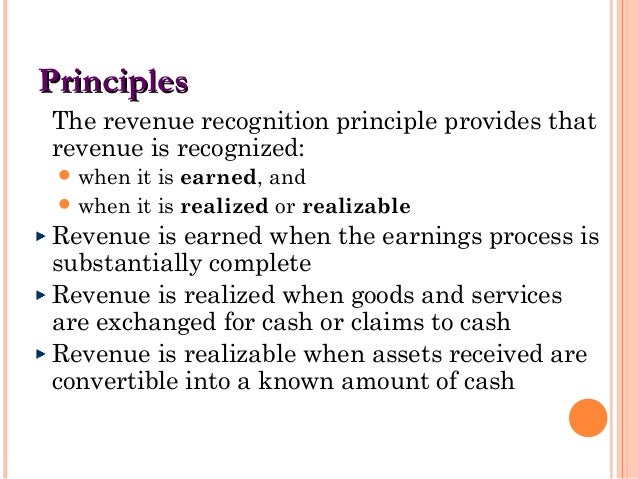

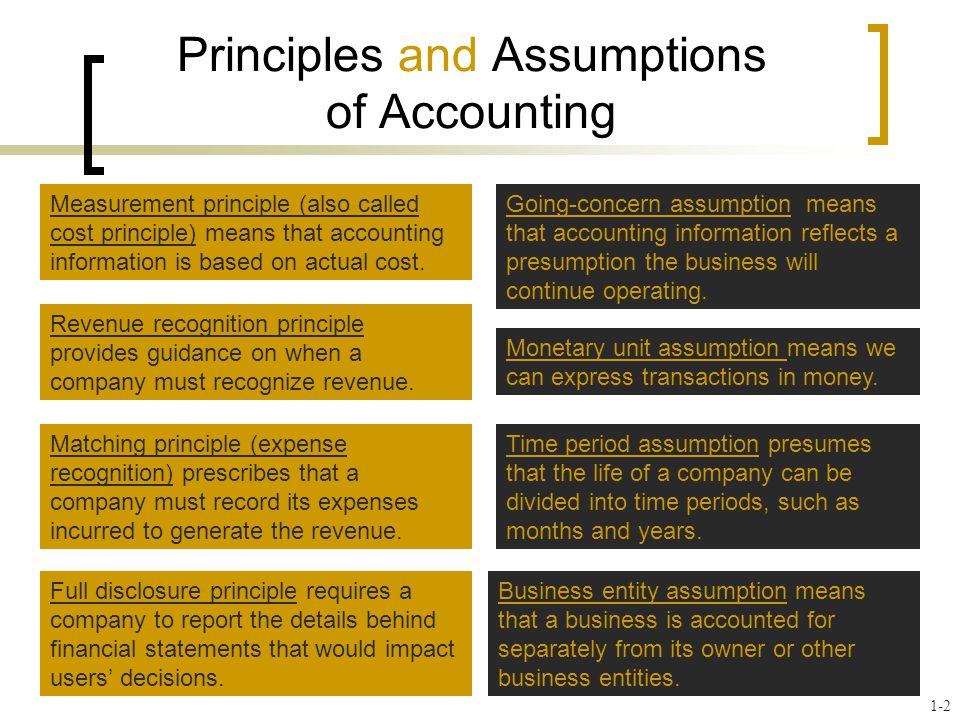

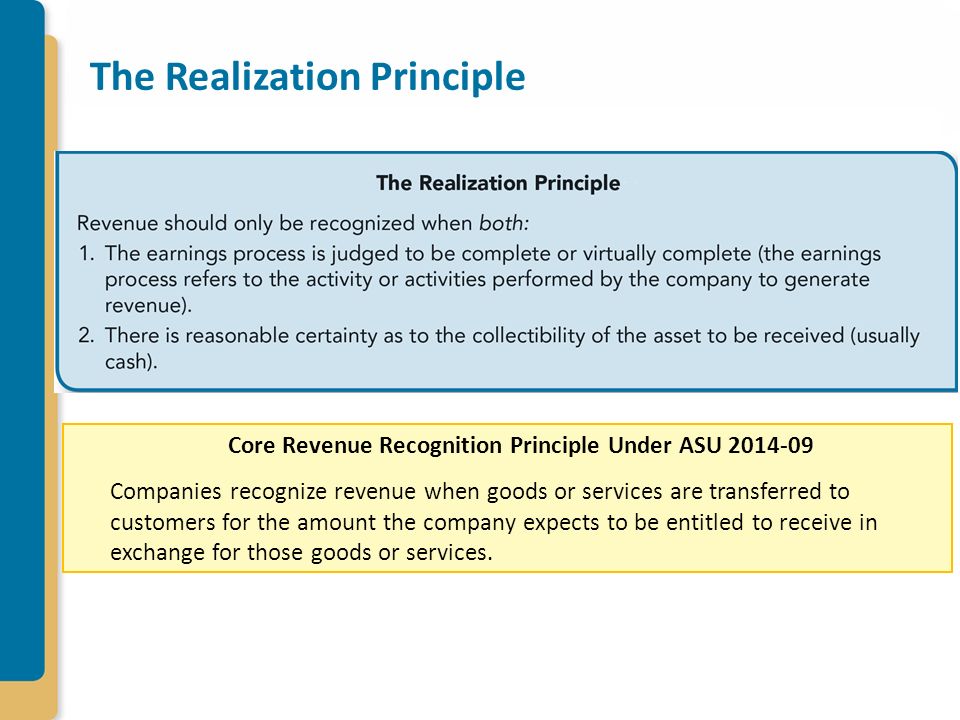

Revenue recognition principle definition. The revenue recognition principle states that one should only record revenue when it has been earned not when the related cash is collected. The accounting guideline requiring that revenues be shown on the income statement in the period in which they are earned not in the period when the cash is collected. The revenue recognition principle states that a company should record and recognize revenue when it is earned and not when the actual cash proceeds are received. They both determine the accounting period in which revenues and expenses are recognized.

The revenue recognition could be different from one accounting principle to another principle and one standard to another standard. The revenue recognition principle is the concept of how the revenue should be recognized in the entity s financial statements. The revenue recognition principle enables your business to show profit and loss accurately since you will be recording revenue when it is earned not when it is received. Revenue recognition principle definition.

It can recognize the revenue immediately. Revenue recognition principle requires that the revenue must be realized or realizable in order to recognize it in the accounting records. The revenue recognition principle is a cornerstone of accrual accounting together with the matching principle. For example a snow plowing service completes the plowing of a company s parking lot for its standard fee of 100.

This is part of the accrual basis of accounting as opposed to the cash basis of accounting. Revenue recognition is a generally accepted accounting principle gaap that stipulates how and when revenue is to be recognized. Revenue recognition is an accounting principle that outlines the specific conditions under which revenue sales revenue sales revenue is the income received by a company from its sales of goods or the provision of services. The revenue recognition principle is an accounting principle that requires revenue to be recorded only when it is earned.