Definition Risk Weighted Assets Basel Iii

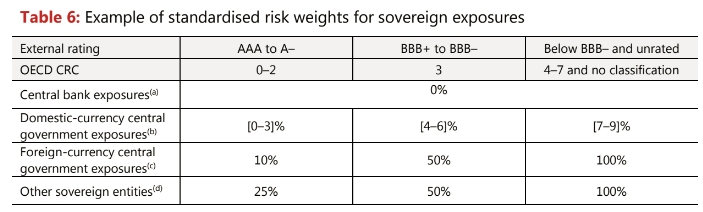

Risk coefficients are determined based on the credit ratings of certain types of bank assets.

Definition risk weighted assets basel iii. This sort of asset calculation is used in determining the capital requirement or capital adequacy ratio car for a financial institution. Risk weighted asset also referred to as rwa is a bank s assets or off balance sheet exposures weighted according to risk. Risk weighted assets is a banking term that refers to an asset classification system that is used to determine the minimum capital that banks should keep as a reserve to reduce the risk of insolvency. Section 4 discusses the worksheets for data collection on the definition of capital including of tlac and.

The committee s now finalised basel iii reforms complement these improvements to the global regulatory framework. Basel iii a set of international banking regulations sets the guidelines around risk weighted assets. The main aims of basel iii rules are to ensure that banks hold sufficient capital maintain healthy leverage and liquidity ratios and build up countercyclical buffers. The revisions seek to restore credibility in the calculation of risk weighted assets rwas and improve the comparability of banks capital ratios by.

Basel i primarily focuses on credit risk and risk weighted assets rwa risk weighted assets risk weighted assets is a banking term that refers to an asset classification system that is used to determine the minimum capital that banks should keep as a reserve to reduce the risk of insolvency. This minimum is based on a risk assessment for each type of bank risk exposure. Risk weighted asset enables a comparison between two different banks operating in two different regions or countries. With basel iii however rwa optimization can become more important as an.

The aim of these accords namely basel i basel ii and basel iii is to ensure that banks and financial institutions have the required amount of capital to absorb the unexpected losses. 5 13 additional data on the basel iii leverage ratio and risk weighted capital requirements for derivatives counterparties panel m. Credit market operational counterparty and credit valuation adjustment risks. Risk weighted assets rwas risk weighted assets are used to determine the minimum amount of regulatory capital that must be held by banks to maintain their solvency.

Banks face the risk of loan borrowers defaulting or investments flatlining and maintaining a minimum amount of capital helps to mitigate the risks.